No matter how hard you try, you'd always set interest rates too high or too low, or supply too much or too little money. This would lead to the inevitable shortages or surpluses that any Economics 101 course teaches to new students. If you don't believe me, please see the terrible record of any centrally planned economy.

And yet, the Federal Reserve still tries to make the economic system more stable through its control of the money supply and interest rates. You'd think they'd learn.

Their failure can be seen, most recently, in the swing of commodity prices and interest rates. Increasing the money supply to bring down interest rates has led to un-intended, but inevitable, consequences, like surging commodity prices and civil disorder in the third world.

The Fed keeps insisting that inflation is low by reference to a) the corrupt Consumer Price Index (CPI) and b) the spread between bonds with and without inflation protection.

The circular reasoning required for b) above just boggles the mind: 1) The economy is inherently unstable, so we need a Federal Reserve to prevent that instability from hurting people (they claim), 2) The Federal Reserve refers to free market interest rates (on the premise that market players aren't just reacting to Federal Reserve talk and action) to decide whether they need to intervene, 3) So, if the Federal Reserve is supposed to prevent an inherently unstable system from becoming unstable, why is it using supposedly unstable misinformation from that unstable system to validate its need to act or not?

It sounds like a recipe for creating an even more unstable system. And, so it has.

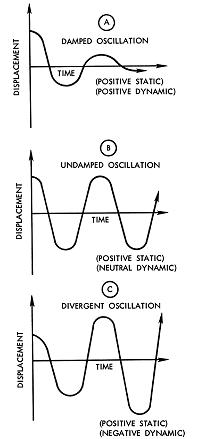

Below are three graphs. A) shows a stable system where equilibrium is restored with damped oscillations over time. B) shows a stable system where oscillations aren't damped, but the system returns to equilibrium periodically and doesn't fall apart. C) shows an unstable system where the oscillations become greater and greater until things blow up or whatever is causing the divergent oscillations is removed.

The claim is made that we need a Federal Reserve because the systems is inherently like B) or C) and the Fed will make things look like A). But, look at the graph below of S&P 500 profit margins. Does it look like the Federal Reserve is making A) happen, or C)? Looks a lot like C) to me!

It is my contention that the economic system is inherently like A) above, not B) or C), and that Fed intervention is turning the economy into first B) and then C) above.

This is by no means a proof or validation, but it should raise a question in your mind that perhaps markets should be setting interest rates and money supply just like it sets the price of t-shirt, TVs, computers and millions of other products. Every experience with price controls in history has led to surpluses and shortages, and yet we have a Federal Reserve trying to set the most important price in the economy--the price of money.

Maybe it's time to dampen our oscillations by removing the thing that's making our system unstable: the Federal Reserve.

Nothing in this blog should be considered investment, financial, tax, or legal advice. The opinions, estimates and projections contained herein are subject to change without notice. Information throughout this blog has been obtained from sources believed to be accurate and reliable, but such accuracy cannot be guaranteed.

3 comments:

Hi - I am definitely delighted to find this. cool job!

You own the talent of brilliant writing I must confess. Your posts incorporates the reality which are not accessible from anywhere else. I request you humbly please keep such brilliant contents.And yes i have book mark your site mikerivers.blogspot.com .

Appreaciate for the work you have done into this post, it helps clear away some questions I had.

Post a Comment