They say patience is a virtue. That doesn't mean it's a whole lot of fun.

Sometimes, I feel like Bill Murray in Groundhog Day, waking up to the same day each and every day and wishing the cycle would end. Each day, I research individual companies with a focus on businesses with competitive advantages and good management selling at low prices. On rare days, when prices deviate enough from fundamentals to merit action, I do some buying and selling. And yet, the cheap companies keep getting cheaper and the expensive ones just get more expensive. I'm waiting patiently for this cycle to end, but it's not much fun.

Unlike Bill in the movie, I'm not trying anything radical to break out of the cycle. As Bill eventually discovers, the cycle ends not from bold or wild action, but from doing the right things. The cycle of the cheap getting cheaper and expensive getting more expensive will end, too. I just need to stay true to my purpose.

So, what allows me to maintain patience? Just like I know virtue leads to happiness and diet and exercise lead to weight loss, I know that buying cheap and selling expensive works over time. Added to this, I understand the concept of growing potential energy.

Potential energy is the result of a force acting on an object over time. When a spring is compressed, it has a lot of potential energy. That potential energy is eventually turned into kinetic energy when the spring is released.

The force, in this case, is crowd momentum causing the expensive to get more expensive. That force, applied over time, is compressing a metaphorical spring, conversely making the cheap become cheaper. That very process, though, leads to its own resolution. Because the system is not in equilibrium, the longer and further the spring is compressed, the more dramatic the eventual release of kinetic energy when the spring's potential energy is transformed.

I have to be patient because no one knows how long crowd momentum will compress the spring (6 years and running, so far). But, knowing that the spring is just getting more and more compressed, creating a growing reserve of potential energy, makes it easier to be patient. I know that the longer the spring is compressed, the greater the reward--the release of kinetic energy--once momentum runs its course.

Or, as 17th century philosopher Spinoza put it, all things excellent are as difficult as they are rare. I'm feeling keenly the difficult and rare part, in time I will gain the excellence as well.

Nothing in this blog should be considered investment, financial, tax, or legal advice. The opinions, estimates and projections contained herein are subject to change without notice. Information throughout this blog has been obtained from sources believed to be accurate and reliable, but such accuracy cannot be guaranteed.

My blog about investing, personal finance, or whatever else I want to write about.

Friday, April 29, 2011

Friday, April 22, 2011

There's no free lunch

One of the most succinct propositions in economics is that there's no such thing as a free lunch. Put more plainly, when you think you're getting something for nothing, you'd best check your premises.

Take free Internet search. Is that really free? No, it's paid for by advertising. Free news from over-the-air broadcasters ABC, NBC and CBS? Advertising. Free advice from financial planners? Commissions on mutual fund sales. Free roads? Check out the taxes you pay on fuel. Free lunch from an insurance salesperson? Commissions, too (an insurance salesperson once bragged to me that he only needed 1 out of 20 people to buy insurance at those events--so you should know right away the "product" is a rip-off!).

There's no such thing as a free lunch.

In no case should this be more obvious than government support of the economy. Hey, if all it really took were the Federal Reserve printing money to promote prosperity, then Wiemar Germany and Zimbabwe would have been the most thriving economies in history. They weren't/aren't (both disasters on scales that make earthquakes and hurricanes economically boring in comparison).

And so, when the Fed ends it's quantitative easing program this summer, we should all be on the lookout for economic tremors. We ate the lunch, now the bill's coming due.

I'm actually quite surprised market participants have been short-sighted on this issue. I naively thought the quantitative easing program hinted at last summer would be seen for what it was--quite costly. Instead, the market started partying like it was 1999.

This attitude will, however, prove short-sighted. Unfortunately, John Q. Public has joined the stampede. As usual, he waited until the herd reached full speed, long after the lead steers saw the Fed's policy as a license to speculate. My guess is that he'll leap off the cliff only to look back and see the lead steers observing the slaughter from the sidelines.

So was it ever.

Perhaps we'll get a third round of quantitative easing and the day of reckoning will be put off. If so, that lunch will be no more free than the last several.

It will be interesting to observe how the lead steers react, and how long it takes for John Q. Public to learn that there are no free lunches.

Nothing in this blog should be considered investment, financial, tax, or legal advice. The opinions, estimates and projections contained herein are subject to change without notice. Information throughout this blog has been obtained from sources believed to be accurate and reliable, but such accuracy cannot be guaranteed.

Take free Internet search. Is that really free? No, it's paid for by advertising. Free news from over-the-air broadcasters ABC, NBC and CBS? Advertising. Free advice from financial planners? Commissions on mutual fund sales. Free roads? Check out the taxes you pay on fuel. Free lunch from an insurance salesperson? Commissions, too (an insurance salesperson once bragged to me that he only needed 1 out of 20 people to buy insurance at those events--so you should know right away the "product" is a rip-off!).

There's no such thing as a free lunch.

In no case should this be more obvious than government support of the economy. Hey, if all it really took were the Federal Reserve printing money to promote prosperity, then Wiemar Germany and Zimbabwe would have been the most thriving economies in history. They weren't/aren't (both disasters on scales that make earthquakes and hurricanes economically boring in comparison).

And so, when the Fed ends it's quantitative easing program this summer, we should all be on the lookout for economic tremors. We ate the lunch, now the bill's coming due.

I'm actually quite surprised market participants have been short-sighted on this issue. I naively thought the quantitative easing program hinted at last summer would be seen for what it was--quite costly. Instead, the market started partying like it was 1999.

This attitude will, however, prove short-sighted. Unfortunately, John Q. Public has joined the stampede. As usual, he waited until the herd reached full speed, long after the lead steers saw the Fed's policy as a license to speculate. My guess is that he'll leap off the cliff only to look back and see the lead steers observing the slaughter from the sidelines.

So was it ever.

Perhaps we'll get a third round of quantitative easing and the day of reckoning will be put off. If so, that lunch will be no more free than the last several.

It will be interesting to observe how the lead steers react, and how long it takes for John Q. Public to learn that there are no free lunches.

Nothing in this blog should be considered investment, financial, tax, or legal advice. The opinions, estimates and projections contained herein are subject to change without notice. Information throughout this blog has been obtained from sources believed to be accurate and reliable, but such accuracy cannot be guaranteed.

Wednesday, April 13, 2011

Creating instability

I don't envy the Federal Reserve. They have an impossible job. Can you imagine trying to set the price of t-shirts for the whole economy, much less the clearing price between suppliers and demanders of funds in capital markets?

No matter how hard you try, you'd always set interest rates too high or too low, or supply too much or too little money. This would lead to the inevitable shortages or surpluses that any Economics 101 course teaches to new students. If you don't believe me, please see the terrible record of any centrally planned economy.

And yet, the Federal Reserve still tries to make the economic system more stable through its control of the money supply and interest rates. You'd think they'd learn.

Their failure can be seen, most recently, in the swing of commodity prices and interest rates. Increasing the money supply to bring down interest rates has led to un-intended, but inevitable, consequences, like surging commodity prices and civil disorder in the third world.

The Fed keeps insisting that inflation is low by reference to a) the corrupt Consumer Price Index (CPI) and b) the spread between bonds with and without inflation protection.

The circular reasoning required for b) above just boggles the mind: 1) The economy is inherently unstable, so we need a Federal Reserve to prevent that instability from hurting people (they claim), 2) The Federal Reserve refers to free market interest rates (on the premise that market players aren't just reacting to Federal Reserve talk and action) to decide whether they need to intervene, 3) So, if the Federal Reserve is supposed to prevent an inherently unstable system from becoming unstable, why is it using supposedly unstable misinformation from that unstable system to validate its need to act or not?

It sounds like a recipe for creating an even more unstable system. And, so it has.

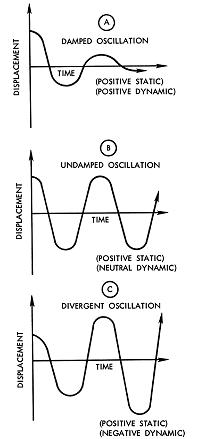

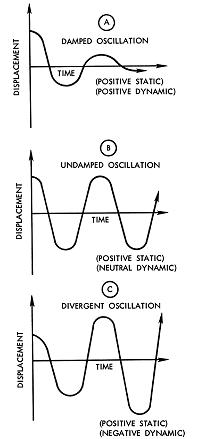

Below are three graphs. A) shows a stable system where equilibrium is restored with damped oscillations over time. B) shows a stable system where oscillations aren't damped, but the system returns to equilibrium periodically and doesn't fall apart. C) shows an unstable system where the oscillations become greater and greater until things blow up or whatever is causing the divergent oscillations is removed.

The claim is made that we need a Federal Reserve because the systems is inherently like B) or C) and the Fed will make things look like A). But, look at the graph below of S&P 500 profit margins. Does it look like the Federal Reserve is making A) happen, or C)? Looks a lot like C) to me!

It is my contention that the economic system is inherently like A) above, not B) or C), and that Fed intervention is turning the economy into first B) and then C) above.

This is by no means a proof or validation, but it should raise a question in your mind that perhaps markets should be setting interest rates and money supply just like it sets the price of t-shirt, TVs, computers and millions of other products. Every experience with price controls in history has led to surpluses and shortages, and yet we have a Federal Reserve trying to set the most important price in the economy--the price of money.

Maybe it's time to dampen our oscillations by removing the thing that's making our system unstable: the Federal Reserve.

Nothing in this blog should be considered investment, financial, tax, or legal advice. The opinions, estimates and projections contained herein are subject to change without notice. Information throughout this blog has been obtained from sources believed to be accurate and reliable, but such accuracy cannot be guaranteed.

No matter how hard you try, you'd always set interest rates too high or too low, or supply too much or too little money. This would lead to the inevitable shortages or surpluses that any Economics 101 course teaches to new students. If you don't believe me, please see the terrible record of any centrally planned economy.

And yet, the Federal Reserve still tries to make the economic system more stable through its control of the money supply and interest rates. You'd think they'd learn.

Their failure can be seen, most recently, in the swing of commodity prices and interest rates. Increasing the money supply to bring down interest rates has led to un-intended, but inevitable, consequences, like surging commodity prices and civil disorder in the third world.

The Fed keeps insisting that inflation is low by reference to a) the corrupt Consumer Price Index (CPI) and b) the spread between bonds with and without inflation protection.

The circular reasoning required for b) above just boggles the mind: 1) The economy is inherently unstable, so we need a Federal Reserve to prevent that instability from hurting people (they claim), 2) The Federal Reserve refers to free market interest rates (on the premise that market players aren't just reacting to Federal Reserve talk and action) to decide whether they need to intervene, 3) So, if the Federal Reserve is supposed to prevent an inherently unstable system from becoming unstable, why is it using supposedly unstable misinformation from that unstable system to validate its need to act or not?

It sounds like a recipe for creating an even more unstable system. And, so it has.

Below are three graphs. A) shows a stable system where equilibrium is restored with damped oscillations over time. B) shows a stable system where oscillations aren't damped, but the system returns to equilibrium periodically and doesn't fall apart. C) shows an unstable system where the oscillations become greater and greater until things blow up or whatever is causing the divergent oscillations is removed.

The claim is made that we need a Federal Reserve because the systems is inherently like B) or C) and the Fed will make things look like A). But, look at the graph below of S&P 500 profit margins. Does it look like the Federal Reserve is making A) happen, or C)? Looks a lot like C) to me!

It is my contention that the economic system is inherently like A) above, not B) or C), and that Fed intervention is turning the economy into first B) and then C) above.

This is by no means a proof or validation, but it should raise a question in your mind that perhaps markets should be setting interest rates and money supply just like it sets the price of t-shirt, TVs, computers and millions of other products. Every experience with price controls in history has led to surpluses and shortages, and yet we have a Federal Reserve trying to set the most important price in the economy--the price of money.

Maybe it's time to dampen our oscillations by removing the thing that's making our system unstable: the Federal Reserve.

Nothing in this blog should be considered investment, financial, tax, or legal advice. The opinions, estimates and projections contained herein are subject to change without notice. Information throughout this blog has been obtained from sources believed to be accurate and reliable, but such accuracy cannot be guaranteed.

Friday, April 08, 2011

Don't just do something, stand there!

We're a can-do people. From a young age, we're taught that effort leads to results. But, when it comes to investing, activity is not the same as effort. In other words, it is frequently better--as an investor--to stand there instead of doing something.

This is tough for can-do people to swallow. They want to trade and switch and act to achieve success. This may work well in many fields, but investing is not one of them. This is as true for professional as non-professional investors.

This point is well made in Michael Mauboussin's latest article, "The Coffee Can Approach."

Mauboussin's article refers to a professional investor's experience with a client. The client had copied some of the professional's initial investment choices in their own separate portfolio and then just forgotten about it for years. Over time, the forgotten portfolio had greatly out-performed the professional's own record. Some investments had done poorly, but others had done so well it was best to leave them alone. Instead of doing something, the professional investor--and his clients--would have been better off doing nothing after the initial allocation.

The difficulty is that this method takes great patience and many years to work out. If you examine your portfolio too frequently, you'll make changes that tend to yield sub-optimal results. Just as a watched pot doesn't boil, an over-examined portfolio doesn't grow.

This framework is born out by research from the investment field.

John Bogle found that exchange-trade fund (ETF) investors were on average under-performing the reported returns of the ETFs they invested in--by a whopping 4.5% a year! Why? Investors were buying things that had gone up and selling things that had gone down. They would have gotten significantly better returns if they had patiently stayed where they were.

Professional investors don't do much better. Institutional plan sponsors--usually investment committees of professionals--consistently fire managers that have recently done poorly and hire managers that have recently done well. The result: the fired managers subsequently out-perform the hired managers by a wide margin. Plan participants would have been significantly better off if plan sponsors had left things alone.

People, both professionals and non-professionals, tend to evaluate investment managers over three year periods. And yet, research indicates that you need a period of a decade or more to confidently conclude a manager has skill.

In fact, some research suggests that only 35% of skilled managers show up in the top 10% over 1 year periods, and only 50% of skilled managers show up in the top 10%--even with a 10 year evaluation period!

When it comes to investing, picking good investments or good managers should focus much more on the initial decision, and then being patient with that choice over time. Without a doubt, this is hard for can-do people to embrace.

The evidence, however, is clear: recent out-performance is no guarantee of future out-performance, and recent under-performance is no proof of poor future performance. With investing--once an good initial decision is made--it's better to stand there than do something.

Nothing in this blog should be considered investment, financial, tax, or legal advice. The opinions, estimates and projections contained herein are subject to change without notice. Information throughout this blog has been obtained from sources believed to be accurate and reliable, but such accuracy cannot be guaranteed.

This is tough for can-do people to swallow. They want to trade and switch and act to achieve success. This may work well in many fields, but investing is not one of them. This is as true for professional as non-professional investors.

This point is well made in Michael Mauboussin's latest article, "The Coffee Can Approach."

Mauboussin's article refers to a professional investor's experience with a client. The client had copied some of the professional's initial investment choices in their own separate portfolio and then just forgotten about it for years. Over time, the forgotten portfolio had greatly out-performed the professional's own record. Some investments had done poorly, but others had done so well it was best to leave them alone. Instead of doing something, the professional investor--and his clients--would have been better off doing nothing after the initial allocation.

The difficulty is that this method takes great patience and many years to work out. If you examine your portfolio too frequently, you'll make changes that tend to yield sub-optimal results. Just as a watched pot doesn't boil, an over-examined portfolio doesn't grow.

This framework is born out by research from the investment field.

John Bogle found that exchange-trade fund (ETF) investors were on average under-performing the reported returns of the ETFs they invested in--by a whopping 4.5% a year! Why? Investors were buying things that had gone up and selling things that had gone down. They would have gotten significantly better returns if they had patiently stayed where they were.

Professional investors don't do much better. Institutional plan sponsors--usually investment committees of professionals--consistently fire managers that have recently done poorly and hire managers that have recently done well. The result: the fired managers subsequently out-perform the hired managers by a wide margin. Plan participants would have been significantly better off if plan sponsors had left things alone.

People, both professionals and non-professionals, tend to evaluate investment managers over three year periods. And yet, research indicates that you need a period of a decade or more to confidently conclude a manager has skill.

In fact, some research suggests that only 35% of skilled managers show up in the top 10% over 1 year periods, and only 50% of skilled managers show up in the top 10%--even with a 10 year evaluation period!

When it comes to investing, picking good investments or good managers should focus much more on the initial decision, and then being patient with that choice over time. Without a doubt, this is hard for can-do people to embrace.

The evidence, however, is clear: recent out-performance is no guarantee of future out-performance, and recent under-performance is no proof of poor future performance. With investing--once an good initial decision is made--it's better to stand there than do something.

Nothing in this blog should be considered investment, financial, tax, or legal advice. The opinions, estimates and projections contained herein are subject to change without notice. Information throughout this blog has been obtained from sources believed to be accurate and reliable, but such accuracy cannot be guaranteed.

Subscribe to:

Posts (Atom)